At IWS, we’re committed to helping you get the most out of your vehicle loan program by providing exceptional auto-protection products for your members — including Vehicle Service Agreements (VSA), Mechanical Breakdown Insurance (MBI) and Guaranteed Asset Protection (GAP) — all backed by highly experienced professionals who deliver unsurpassed service.

People first. Products that work.

PIC: Your One-Stop Resource for Increased Loan Productivity

Our PIC is a dedicated sales and information center that provides your members outstanding products for their vehicle, as well as safeguards for their loan. It offers compelling value and turnkey convenience. Through the PIC, IWS educates members about their protection options, explaining the benefits, answering questions and providing customized, affordable solutions.

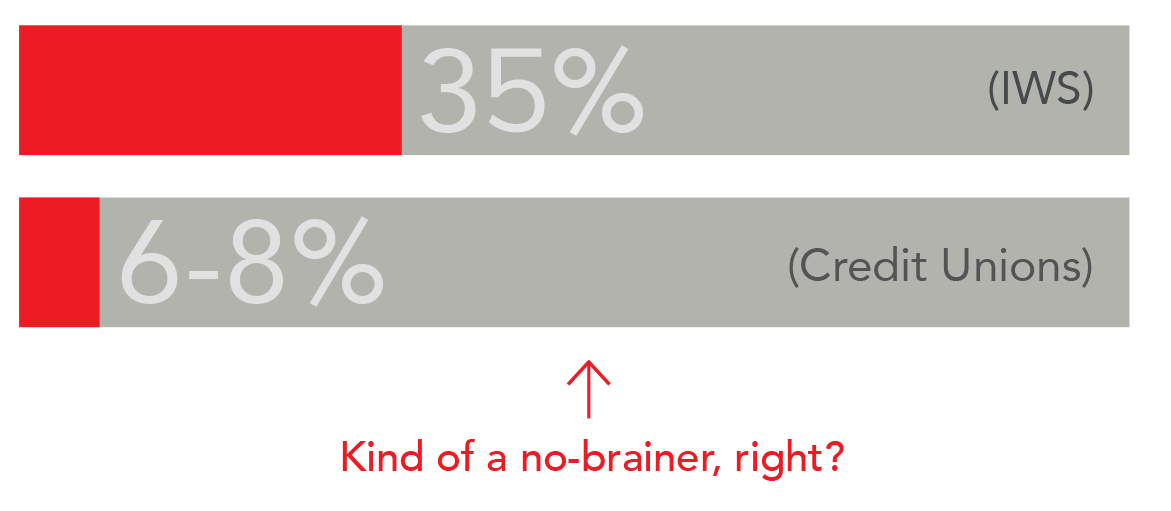

Our research indicates that credit unions sell VSAs on average to only 6%–8% of members. By comparison, the IWS PIC sells a VSA/MBI to members an average of 35% of the time. That’s four times the success rate — plus, it enables credit unions to protect more of their collateral.

These days, consumers hold off longer between vehicle purchases. And they opt for longer loan terms. That increases the chance they’ll face a hefty repair bill before their vehicle is paid off. Yet nearly one in three U.S. motorists cannot pay for the average $500-$600 repair bill without going into debt. A VSA/MBI can help members avoid the financial peril that can result from an unforeseen repair

Once a vehicle loan is approved, your credit union decides when to connect members on the phone with the PIC — and also whether to remain on the phone with members to answer questions, including what their monthly auto loan payments will be when the cost of a VSA/MBI is built into their loan.

Call it superior sales expertise or simply confidence: IWS guarantees that, in the first year, 20% of the direct auto loans referred to our PIC will result in a VSA/MBI sale. If that number falls short, IWS will pay your credit union the unrealized income for those VSAs/MBIs.

Work less, earn more. When members are referred to our Product Information Center, IWS converts 35% of those leads to VSAs/MBIs. In contrast, we’ve found that credit unions on average sell a VSA/MBI to 6-8% of members.

Running a thriving credit union in today’s competitive marketplace is no easy task. IWS eliminates the repetitive, time-consuming chore of selling VSAs/MBIs and training your staff — time that you can put to better use to generate more loans.

Since 1991, IWS has served credit unions exclusively. We know our business — and we know yours. Contact us for more information about PIC and the income-generating and time-saving benefits it offers.